CT JD-FM-150 2014-2026 free printable template

Show details

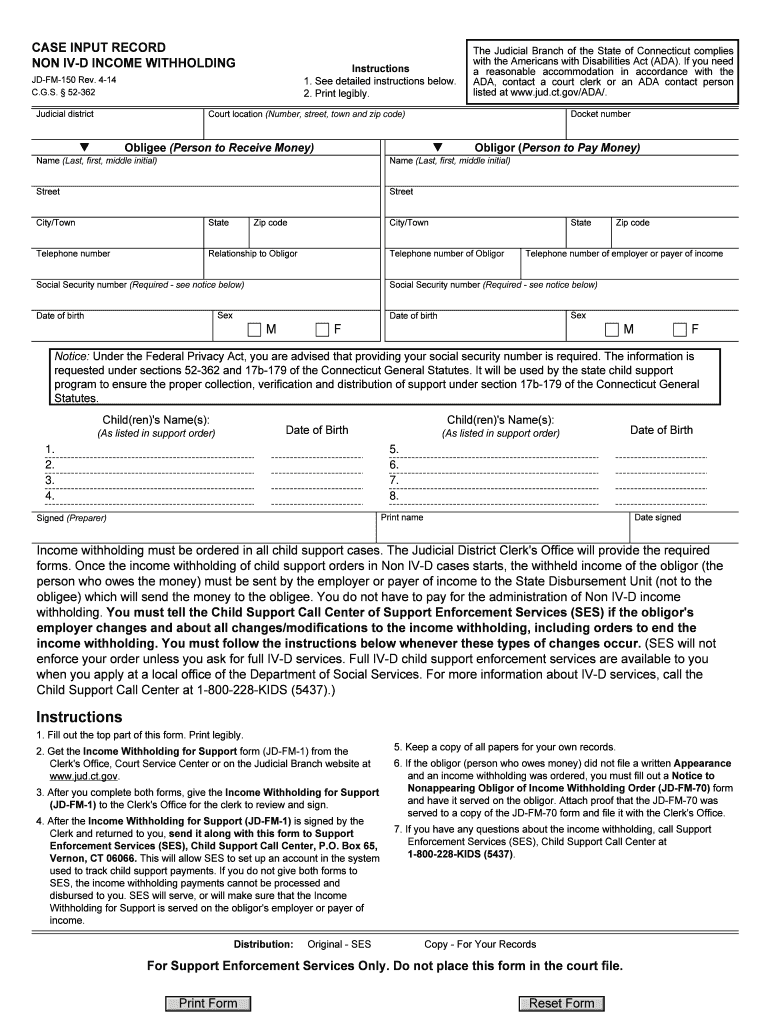

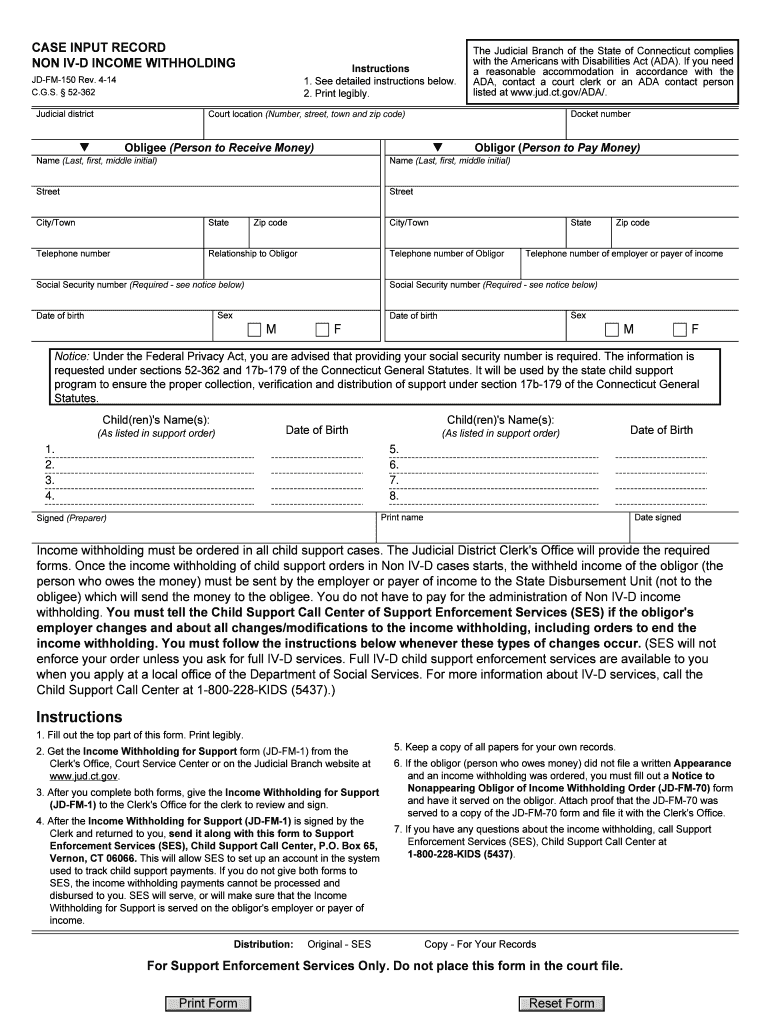

JD-FM-150 Rev. 4-14 C. G.S. 52-362 Judicial district The Judicial Branch of the State of Connecticut complies with the Americans with Disabilities Act ADA. CASE INPUT RECORD NON IV-D INCOME WITHHOLDING Instructions 1. See detailed instructions below. 2. Print legibly. If you need a reasonable accommodation in accordance with the ADA contact a court clerk or an ADA contact person listed at www. jud. ct. gov/ADA/. Docket number Court location Number street town and zip code Obligee Person to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign caseflow request family matters form jd fm 292

Edit your 1022 form filled sample newborn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT JD-FM-150 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT JD-FM-150 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CT JD-FM-150. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CT JD-FM-150

How to fill out CT JD-FM-150

01

Obtain a copy of the CT JD-FM-150 form from the relevant authority's website or office.

02

Carefully read the instructions provided at the top of the form to understand the requirements.

03

Fill out the 'Applicant Information' section with your personal details including name, address, and contact information.

04

In the 'Property Information' section, provide details about the property in question, such as address and type.

05

Complete the 'Basis for Application' section by clearly stating the purpose for which you are completing the form.

06

Ensure all required signatures are added where indicated.

07

Review your filled form for any errors or missing information.

08

Submit the completed form to the appropriate department either by mail or in person as instructed.

Who needs CT JD-FM-150?

01

Individuals applying for a specific property-related matter in Connecticut, such as homeowners, landlords, or real estate professionals.

Fill

form

: Try Risk Free

People Also Ask about

What is a remote hearing in CT court?

Remote court proceedings are just like any other in-court proceeding; the only difference is that in a remote court proceeding, some or all of the participants may not be in the same physical space.

What is a caseflow request family matters form jd fm 292?

A new Family Caseflow Request/Request for Earlier Hearing on Motion(s) (form JD-FM-292) was created, designed specifically for use in family matters. The form incorporates the prior form for requesting an earlier hearing on a motion, and adds other caseflow request options.

What is a caseflow request in CT?

Caseflow Management is a system by which the Court intervenes in proceedings which are progressing slowly to help parties bring them to a timely resolution.

What is the order of pleadings in CT?

“The order of pleadings shall be as follows: (1) The plaintiff's complaint. (2) The defendant's motion to dismiss the complaint. (3) The defendant's request to revise the complaint.

What is considered child abandonment in CT?

Child abandonment occurs when a parent, guardian or other person in possession of a child either abandons a child without any regard for that child's physical safety, health or well being, or when the child is not receiving the necessary care for a healthy existence.

How do I get my child support back in CT?

If you are behind on making payments, Support Enforcement Services can collect back child support in different ways, including by taking money from your paycheck, tax refund, and/or bank account.

How do I stop child support in CT?

If you're a paying parent, you cannot simply stop paying or reduce child support. You can, however, apply for a Post Judgment modification. Generally speaking, if your child lives in Connecticut, you can request that a Connecticut court change the order.

When can I stop paying child support in Connecticut?

Usually, the duty to support created by a child support order ends when the child is 18 years old.

Do you still have to pay child support if the child goes to college in Connecticut?

However, about 20 states authorize payments for post-secondary educational expenses. In some cases it is because the state places the age of majority, and thus the age to which child support must be paid, at 21. In Connecticut it is 18.

How do I file an appearance in court in Connecticut?

You must file an "Appearance" Form (JD-CL-12) with the court clerk's office. It includes your name, address, telephone number, and signature. It tells the court that you are representing yourself. Filing it allows the court to contact you about all court events in your case.

How do I stop child support payments in CT?

If you're a paying parent, you cannot simply stop paying or reduce child support. You can, however, apply for a Post Judgment modification. Generally speaking, if your child lives in Connecticut, you can request that a Connecticut court change the order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CT JD-FM-150 to be eSigned by others?

Once your CT JD-FM-150 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute CT JD-FM-150 online?

pdfFiller makes it easy to finish and sign CT JD-FM-150 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out CT JD-FM-150 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your CT JD-FM-150. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CT JD-FM-150?

CT JD-FM-150 is a form used in Connecticut for reporting information related to certain family matters, including but not limited to child custody and visitation.

Who is required to file CT JD-FM-150?

Individuals involved in family court matters that require the disclosure of information about child custody, visitation, or parenting plans are typically required to file CT JD-FM-150.

How to fill out CT JD-FM-150?

To fill out CT JD-FM-150, applicants should carefully read the instructions provided with the form, enter the required information accurately in the designated fields, and ensure all necessary documentation is attached before submission.

What is the purpose of CT JD-FM-150?

The purpose of CT JD-FM-150 is to provide the court with essential information regarding the custody and visitation arrangements for children involved in family law cases.

What information must be reported on CT JD-FM-150?

CT JD-FM-150 requires reporting information such as the names of the children, the parties involved, the nature of the custody arrangement, existing orders, and any relevant past or ongoing circumstances affecting the child's welfare.

Fill out your CT JD-FM-150 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT JD-FM-150 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.